What is the FAFSA?

Many students face the challenge of securing economic support to make their education more affordable. College-bound students submit the Free Application for Federal Student Aid (or FAFSA) to determine their eligibility for government financial aid. In recent years, the FAFSA has undergone significant changes to its processes. The new FAFSA rollout has been, shall we say, less than perfect. To cut through some of the chaos, here are the answers to some frequently asked questions about the new FAFSA:

When is the new application available?

Right now! Well, technically now…

The Department of Education (DOE) soft-launched the newest version on December 30, meaning applicants can only access forms intermittently as the bureau works to resolve technical issues.

When is this new FAFSA due?

As of today, the federal deadline to submit is June 30, 2025. However, each state has its own deadline, as does each academic institution. Contact that college’s financial aid office for the most complete or up-to-date information. According to the FSA office, they plan to begin submitting eligibility for financial assistance to universities sometime in late January.

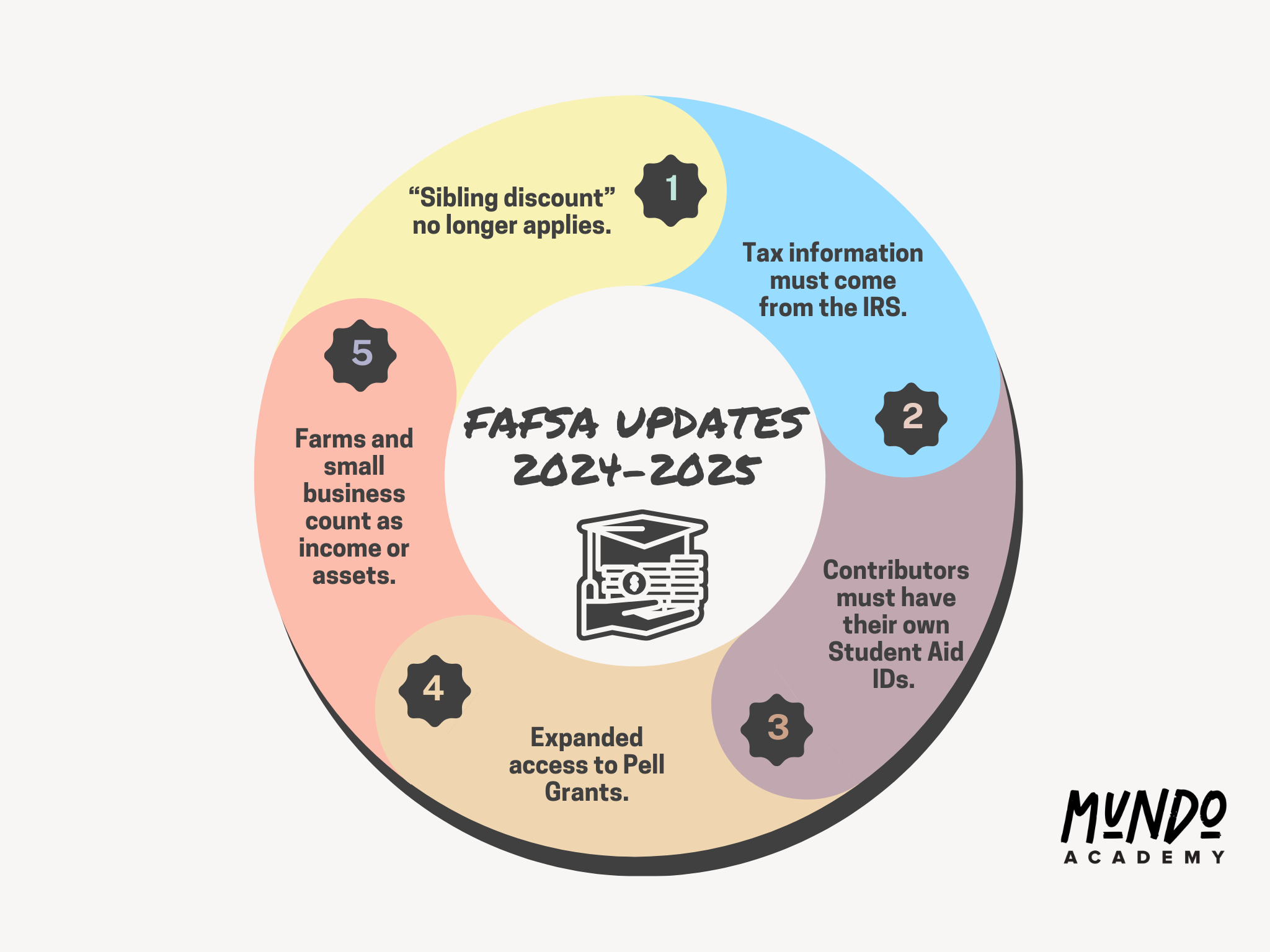

So, what has changed on the FAFSA form?

Fewer questions and expanded access:

The new FAFSA is intended to be less complicated than its predecessor. (The number of potential questions an applicant may answer has shrunk from 108 to 46.) Students may also list up to twenty colleges instead of ten and can now access the application in eleven languages.

Required IRS access and terminology changes:

Users (and contributors) must grant the DOE access to their IRS tax data. Most users’ tax information will be automatically uploaded to their application. The eligibility calculator, once termed the Expected Family Contribution (EFC), is now called the Student Aid Index (SAI).

The term “contributor” is new to this version, defined as anyone required to provide information on an applicant’s forms, such as a parent or spouse. Student responses will dictate whether anyone will need to supply additional information. Contributors will be notified via email and prompted to create a login for access. For dependant students with divorced or separated caregivers, financial information is needed from the individual providing the most economic support to the applicant.

Other household and income changes:

Unfortunately, having multiple household members enrolled in a university (or the “sibling discount”) no longer factors into eligibility determinations. Additionally, small businesses or farms are no longer exempt from valuation, and these assets may decrease the amount of financial aid awarded. However, more applicants may qualify for Pell Grants under the new FAFSA, as eligibility will be tied to family size and the federal poverty level.

I am still having trouble accessing the FAFSA; what can I do?

Most importantly, don’t panic.

Despite the technical headaches, over half a million applicants have successfully filled out their FAFSAs since December 30. The best advice is to just keep at it and submit your materials as soon as possible.

In the meantime, applicants can collect all the necessary paperwork and data to complete their FAFSA. (Think tax returns, income records, Social Security numbers, etc.) Applicants may wish to create their FSA ID or estimate their possible financial aid packages using this tool. Given the truncated timeline and other potential delays, these estimates may guide their decision-making as they await their financial aid determinations.

As always, Mundo is here to help. Please visit our Instagram and other blog posts for more information about the FAFSA or general collegiate prep.